GoodRx, a healthcare platform that offers telemedicine and prescription drug discounts, has agreed to acquire vitaCare Prescription Services for $150 million.

GoodRx is acquiring the technology and services platform from TherapeuticsMD, a women’s healthcare company, to continue expanding its pharma manufacturer solutions business. GoodRx’s pharma manufacturer solutions business works with pharmaceutical manufacturers to boost awareness of savings programs among patients and prescribers directly on the its website.

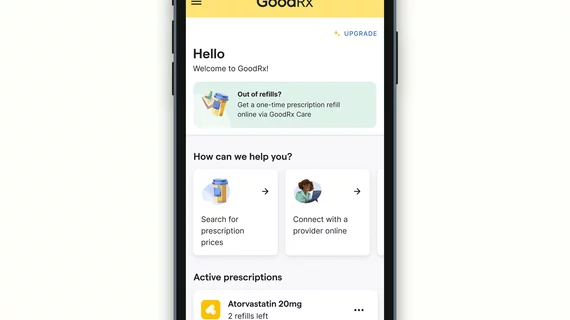

VitaCare aims to make the process of filling prescription drugs simpler and more cost-effective by helping patients navigate key access and adherence barriers for brand medications. VitaCare helps patients understand how they can save and facilitates communications between providers and payors. Patients can also fill prescriptions on the platform through a network of third-party pharmacies.

Like GoodRx, vitaCare’s services aim to help patients fill their prescriptions. Of that 500 million brand prescriptions written every year, only half are filled. Plus, of the filled prescriptions, 29% of patients experienced a delay in receiving their medication due to insurance processes and provider communication delays, according to GoodRx. GoodRx views the acquisition as adding another tool to help patients with access and affordability to their medications in addition to expanding its pharma manufacturer solutions offerings.

“Pharma manufacturers want to help patients find affordable options but too many consumers still face affordability challenges or complex reimbursement processes,” said Doug Hirsch, co-CEO and co-founder of GoodRx. “With vitaCare, we aim to grow our reach and provide new tools for both consumers and providers to help ensure that more patients can access relevant savings programs and navigate prior authorization requirements. We’re excited about the potential to help patients from the point of prescribing through their ongoing refills to ensure they can stay healthy.”

GoodRx has agreed to acquire the company for $150 million in cash, plus $7 million consideration contingent upon vitaCare’s financial performance through 2023. The deal is expected to close mid-2022, subject to customary closing conditions.